So, as you all know, I am confident we are heading to a time where the government is going to have complete control over every purchase we make, every move we make, and every medical decision we make. This has caused me to remain vigilant when it comes to seeing signs moving us in that direction. This brings me to my bank account.

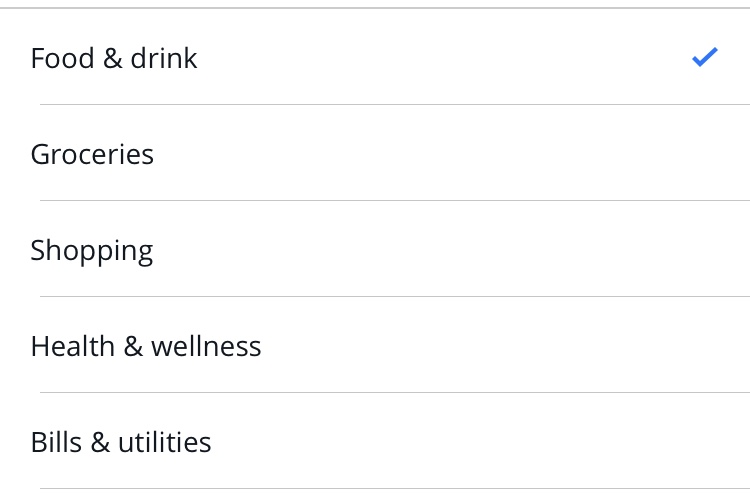

To quickly summarize, I had noticed that my bank account was suddenly categorizing my expenses into groups like: income, health & fitness, food & dining, travel, business services, pet supplies, etc… I immediately noticed they were mislabeling funds under the income category, which Biden is pushing to be forwarded directly to the IRS (this is primarily to tax those making profits off of crypto, but they’ll come for you too). To build a social score system for how and where you will be able to spend your funds or get access to locations or services, and for big government to spy on every dollar spent, a structure must first be built. I quickly looked for the 3rd party disclaimer to see who was organizing my personal financial data, and found “account aggregation services are provided by Yodlee, our third-party vendor. Data is obtained by Yodlee or manually entered.” I then went to the section that allegedly allows you to limit data that is shared, only limiting Yodlee wasn’t an option. I called my bank and asked when the contract began and I was told in 2016. I asked if they were selling my data, and the man didn’t know. I requested it be removed and was told they cannot do that. I am planning on moving my account as soon as I can find a local bank that will allow me to buy crypto with my money.

I did some more digging and apparently Yodlee has a class action lawsuit against them. They were acquired by Envestnet in 2015. Envestnet works with 17 of the top 20 banks along with 5,200 other banks, financial institutions, and companies. They serve $4.8 trillion in assets, manage $229 billion in assets. It’s a monster of a company. In 2018, BlackRock, the world’s largest investment manager, bought an equity stake in Envestnet and partnered with them to integrate their technology with Envestnet’s. The following year, Envestnet’s CEO and his wife, died in a fatal car crash, just after BlackRock’s “Going Direct” technology was put into place. The board of BlackRock has had plenty of people who served in the Biden, Obama, and Clinton administrations – Cheryl Mills being one. The World Economic Forum mentions BlackRock almost every conference of theirs that I watch. BlackRock, Vanguard, and JP Morgan Chase are the top three shareholders of Envestnet. Guess what bank I was using? Chase. Envestnet also acquired Harvest Savings in April 2021. Guess what they’re known for? Launching crypto ( https://riabiz.com/a/2021/4/15/envestnet-orion-and-schwab-will-all-launch-crypto-capabilities-soon-enough-insiders-say-but-damon-deru-just-beat-them-all-to-market-with-more-than-a-hack). Are they going to help Biden launch a digital currency for the U.S.? I am against anything of the sort. It defeats the purpose of crypto being neutral like the internet.

Under the guise of “financial wellness” or “investment snapshots”, they have shifted the financial industry to streamline and surveil everyone’s financial data so that they can control it through a social score system, tell you how and where to spend your money, and take what they deem should go to the IRS. And, as I stated above, they mislabel “funds” all the time on my account. I believe the stimulus checks were direct deposited so they could establish some kind of comprehensive database of U.S. citizens accounts. Even the PPP small business loans helped to collect data on farmers and small businesses. Those checks had nothing to do with helping you. This is tyranny and it’s not something we should be looking to work around. Instead, we need to combat it head on. Are you ready?